Twitter co-founder and CEO Jack Dorsey Sunday stated”people of Nigeria can direct bitcoin” regardless of the Nigerian government clamp down on the trading of cryptocurrencies.

Dorsey’s consider was an immediate response to a oped composed by NFL star Russell Okung at Bitcoin Magazine.

Okung, a fellow descendant and self-acclaimed Bitcoin proponent, advised Nigeria to concentrate on attaining”economic liberty and fiscal sovereignty” by setting a Bitcoin Standard.

Some people of Nigeria can direct #bitcoin:flag-ng: https://t.co/A8Ev3tMkJS

— port (@jack) June 13, 2021

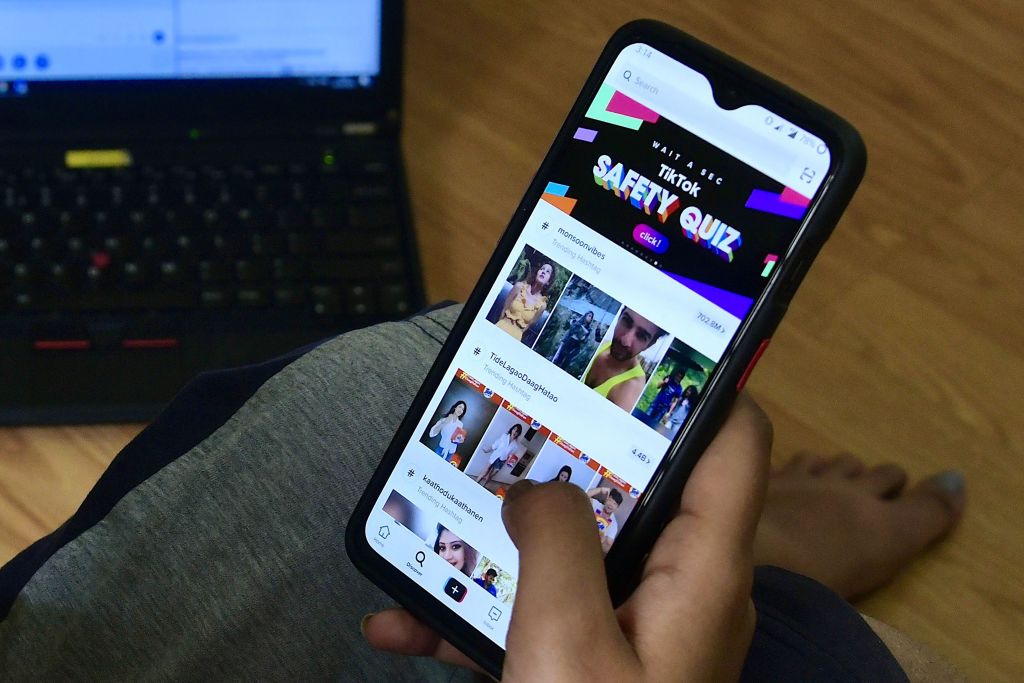

Nigeria is among the most significant cryptocurrency markets on the planet. However, the nation’s central bank banned financial institutions out of trading from cryptocurrency.

Banks were ordered to recognize and shut down all accounts included with the exchange or transfer of cryptocurrencies.

“The lender hereby wants to remind controlled financial institutions which coping with cryptocurrencies or easing payments for cryptocurrency exchanges is illegal,” that the CBN said in a declaration.

However, roughly $400 million worth of cryptocurrencies are traded in Nigeria at 2021, Statista, also a international marketplace statistics tracker, stated. The quantity of trading puts it behind only the USA and Russia from the entire world.

Regardless of the government’s actions, lots of young Nigerians found alternate methods of getting and selling cryptocurrencies since the nation’s currency, the naira, proceeds to slip against the dollar.

“it’s no secret that the present international financial environment is painful and unsustainable,” Okung composed at the oped. “Regrettably, the destiny of the economy is in the control of international central bankers who don’t reflect the best interests of the Nigerian men and women. Regardless of the challenges we confront, the durability of Nigerians has been inspire”

Okung insisted that it’s”pressing” for Nigeria to behave and the nation has a”restricted window”. He pointed into the limited supply of the electronic money as among its most important attractions.

He maintained that Iran, Russia, China and Kenya are already”mining or utilising bitcoin,” partially as a method of bypassing the United States sanctions that forbid them from full involvement in the world monetary system.

“Other countries like Barbados, Singapore and Malta have proceeded to eventually become”bitcoin favorable” in a bid to draw wealth and human capital during migration,” Okung composed.

El Salvador, a week, became the first nation on earth to reevaluate bitcoin as a lawful tender, weeks following China renewed its crackdown on cryptocurrency.

The CBN recently stated it had been beginning an electronic money of its own after this season.

Bitcoin and demonstration

Dorsey’s tweet Sunday came after Nigeria celebrated Democracy Day, together with lots of individuals hitting the streets of cities from the nation to protest against poor governance.

Several days before, Nigerian police suspended the operations of Twitter from the nation, citing its”persistent” usage for actions that jeopardized the”corporate presence” in the West African nation.

The suspension has been countered with the deletion of all President Muhammadu Buhari’s tweet which referenced on the Nigerian Civil War. Twitter stated the tweet offended its”violent behavior” rule.

But critics said that the government’s actions has been an assault against freedom of speech. Twitter plays a significant part expressing criticisms of the authorities in the nation.

It had been utilized to mobilise young Nigerians to combine with the #EndSARS protests against police brutality past October. The protests gained global focus on world leaders and actors tweeting in service.

Dorsey also affirmed the protests and also canvassed contributions to be forced to protesters in bitcoins.

In the months which followedNigeria clamped down to crypto trading, stating”opaque” currencies can be used to launder stolen cash and finance terrorism. Nigeria is presently combating Boko Haram insurgency and contains among the most corrupt people on earth.

Dorsey’s curiosity about Bitcoin isn’t a secret. Earlier in Junehe declared on Twitter his firm Square was contemplating making a hardware pocket to get bitcoin.

“When we do it, then we’d build it completely from the open, from software to hardware layout, also in cooperation with the neighborhood. We wish to kick this off thinking the ideal way,” he explained.