The City regulator is on the lookout for views about the best way best to handle the problem of high-risk investment choices, stressing a lot of customers are unwittingly carrying too much risk with their cash.

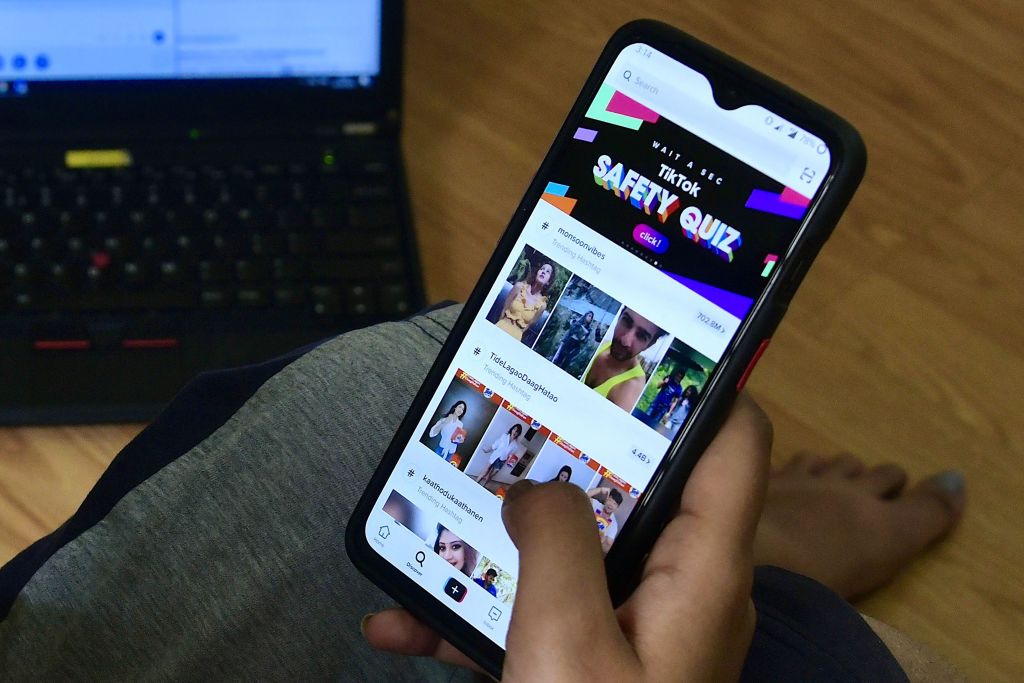

The watchdog has lately cautioned that young people particularly are participating with speculative investments such as foreign market and cryptocurrency, a tendency in a part being driven by societal networking and the increase of so-called’finfluencers’ on platforms such as TikTok.

The FCA is looking especially in promotions of speculative investments, and also any modifications it can cause its own rules to make consumers more powerful.

That saidthe FCA’s hands are attached into a particular degree, as numerous insecure investments are jobless, and thus that the issuer is a real individual, meaning that they don’t encounter the FCA’s extent.

The regulator might like opinions regarding the classification of investments that are high-risk, which decides the degree of advertising restrictions that are relevant to the solution or business; means to section high-risk investments from other people; and also on how best to track whether financial penalties are fair, clear and not misleading in an continuing basis.

Sheldon Mills, executive manager of both competition and consumers in the FCA, stated:’We’re worried that too often customers are buying high-risk investments that they do not know and may result in abrupt and significant losses’

Adverts for Bitcoin could be located on the London Underground, and also young people particularly are very likely to encounter amateur dealers on social networking, asserting investment success is as straightforward as buying low and selling highquality.

‘How firms explain themselves isn’t controlled,’ he explained. ‘The expression’FCA controlled’ doesn’t tell people if they’re walking into a financial institution, an investment system, or efficiently in an internet casino. ‘FCA controlled’ does not mean very much once you’ve lost your top by accidentally investing in complicated devices before realising it.

II head of pensions and savings Becky O’Connor said individuals atmosphere’flush’ later lockdown were seeking for quick methods for creating a profit, placing them in danger of investing in high risk products which aren’t appropriate for their own circumstances.

‘It is becoming more and more hard for ordinary investors to figure out exactly what is and is not valid though, also. There is a’Wild West’ texture to some parts of their investment marketplace today. It creates doing your research and establishing understanding for yourself all of the more significant,’ she explained.

Goods like P2P financing, crowdfunding and cryptoassets can come under closer scrutiny and possibly face greater constraints on which they could be promoted to.

Matt Hopkins, head of electronic banking & fintech in BDO, included:’That is a very clear sign that the FCA is planning to deliver high-risk investment into a conclusion for retail investors.

‘P2P platforms have seen limitations placed on how they advertise their merchandise, and now’s newspaper is a indication that additional regulation might be arriving.’