The advantage is presently trading over $61170 according to information in CoinMarketCap.

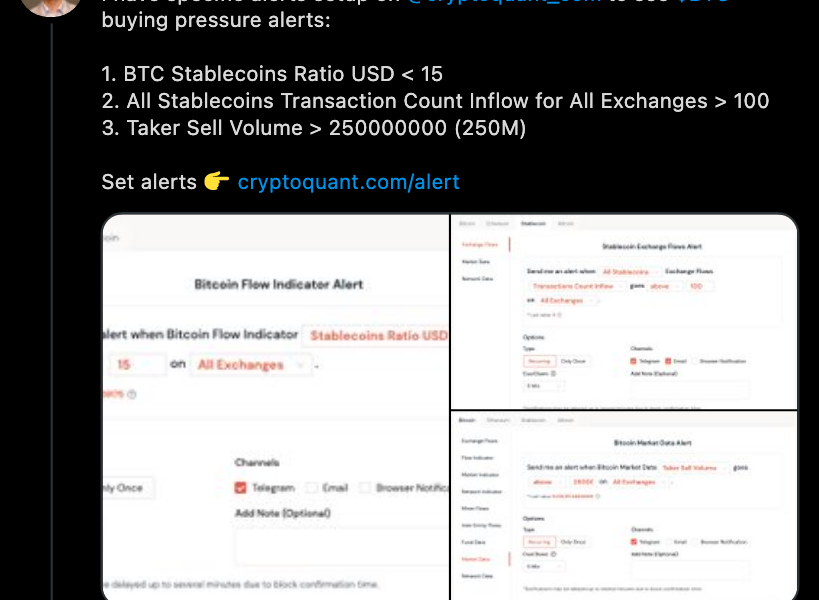

Through the bull’s rally of the present market cycle, there are numerous indications and conditions with an immediate effect on Bitcoin’s cost. CryptoQuant CEO Ki Young Ju advocated setting alarms for some particular conditions which could indicate a change of this tendency from the united states. These particular conditions when fulfilled would result in some near/immediate fall in cost.

Another important index of Bitcoin’s rising buying strain, is that the variety of stablecoin residue across all trades, signaling on-chain purchasing pressure, along with the superior gap on Coinbase. Stablecoins are utilized for transferring Bitcoin throughout exchanges, but that’s broadly known. What is more, is they are sometimes used for gross profit in derivative trades, therefore it is not always a bullish sign for the cost rally, but it might be a volatility sign. Furthermore, Bitcoin’s Taker Economy Volume, the entire volume of market orders full of takers in ceaseless swaps in most derivative trades has crucial indications of this strength’s trend change and cost correction in the continuing market cycle.

A powerful buying pressure, in a period when institutional requirement is up, dependent on Coinbase expert outflow indicates a bullish opinion and construction buying pressure. Furthermore, rising retail requirement with increasing busy speeches and pockets with an equilibrium more than 0.1 Bitcoin, indicates a bullish opinion over this weekend.

Although the belief is impartial, the cost is forecast to begin detection beyond $63000 following the weekend. Purchasing pressure has led to a different ATH over $61k and when there’s a price correction at the present price rally, then it could drop below $57000 within the subsequent week. But in the event the purchasing pressure on Bitcoin proceeds to climb on place markets, the asset’s cost rally will extend past $63000, in the long run. The present cost action also indicates a bullish opinion on derivatives trades and Bitcoin’s goal of 63000 will be attained.